June 2025 Vol. 80 No. 6

Features

Fiber drives HDD growth as big-rig pipeline work returns

By Robert Carpenter, Editor-in-Chief

(UI) — A year ago, the horizontal directional drilling (HDD) market was in the midst of accelerating through another very strong year – for small-to-medium rig operators. Fiber construction continued to push to another level of demand and HDD, the construction medium seemingly made for fiber installation, was desperately trying to keep up with booming project appetites across America.

Further, investments by power utilities to strengthen their grid meant that many overhead lines were being transferred underground for both distribution and even transmission lines. All this added more pressure to perform for the HDD industry.

Yet, the large rig segment of the HDD industry remained tentative, largely due to struggling energy markets. Pipelines were stuck in malaise of energy politics resulting in little to no new pipeline construction. Large rig work was surviving, depending on water, electric transmission and a host of other applications. But to prosper, energy pipeline projects were the missing ingredient for the large rig market.

Fast forward to the pending summer of 2025 and in many ways, not a lot has changed. Small rig operators are being stretched to their limits even as new contractors are entering the HDD market in hopes of riding the fiber wave to prosperity. The good news is that large rig activity is gearing back up with the rebirth of pipeline construction opportunities.

“Like any industry, HDD has challenges and issues. But overall, it is a very active industry with opportunities,” said this Mountain states contractor. “It’s a good time to be a driller.”

New year, new challenges

But 2025 carries different dynamics. The distribution chain for construction equipment has leveled out from previous problems. Most small rig contractors, primarily working with fiber and power, report they are working at near capacity and turn-around time in the supply chain for fiber installation equipment is sometimes a little slower than they would like, but fortunately it is improving. Overall, contractors believe they are keeping pace with the speed of construction demanded by fiber owners.

However, one of the problems existing contractors report is that filling some of the excess capacity needed to keep fiber installation rolling are new contractors, just entering the market.

“There are enough new companies jumping into fiber work that the market remains too competitive,” observed this Southwest contractor. “The problem is too many of the new guys don’t yet have the business savvy for HDD and are leaving money on the table, rushing jobs and not working safe. That hurts everyone as it keeps margins too tight and it can be really hard to stay profitable. The fiber companies don’t seem to care about maintaining a safe industry and high quality work; they just wanted fiber in the ground – now!”

For more than 27 years, Underground Infrastructure has been conducting research into the unique technology and applications of HDD and its impacts upon the utility and pipeline markets. This research effort was conducted during March, April and early May of 2025. It polled U.S. contractors that actively own and operate HDD units to enable a statistical portrayal of the market, from small rigs to large and jumbo models.

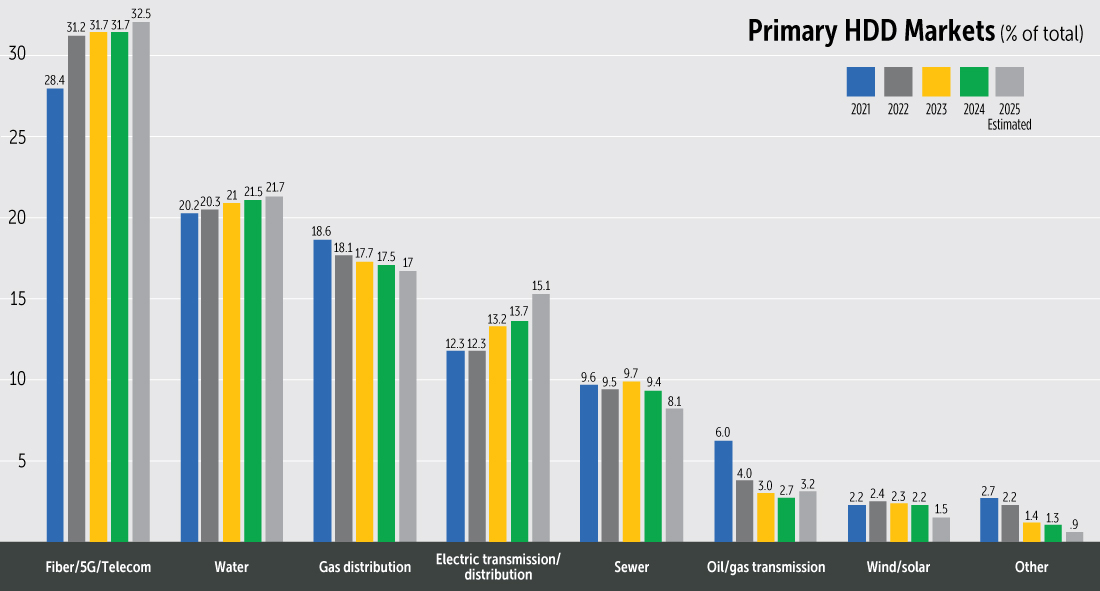

The primary HDD markets are fiber/5G with a 32.5 percent market share, water at 21.7 percent share. Gas distribution fell slightly to 17 percent, electric work grew to 15.1 percent, sewer fell to 8.1 percent, oil and gas transmission pipelines drilling is expected to experience an increase to 3.2 percent, wind and solar work fell to about 1.5 percent of the market and finally, all other applications comprise .9 percent of the market.

The workforce problem that has plagued the HDD market in recent years is still a major issue, though most contractors report a slight easing of the labor pool tightness. “Is it [labor] still a big problem? Sure, but nothing like it has been,” reported this contractor from the Southeast. Another contractor from the Southwest reports that “finding good labor is always a challenge and we’re having to be creative – like everyone – to attract good help. But by and large, we’re getting by.” And yet another contractor from the Midwest stressed that “in our region, people see HDD crews installing fiber everywhere. That’s actually brought us several inquiries from people looking for a better paying career.”

Big rigs return

Now, too, the large rig contractors are gearing up with new projects emerging and a positive outlook that the pipeline market will be strong – at least in the near future. The past four years were marked by a variety of factors that negatively impacted the large rig HDD segment. Most pronounced was the President Biden administration heavily emphasizing environmental and government control through regulation over the energy industry.

In essence, alternative energy options received staunch support through federal funding, tax incentives and favorable rules/regulatory support, while traditional forms of energy ran into increasing numbers of roadblocks via incessant litigation, regulation, restrictions and layers of red tape. Famously, there was even a court case that allowed a previously approved, constructed and up-and-running pipeline to be shut down for renewed EPA evaluation.

However, the re-election of Donald Trump as the nation’s 47th president has brought major changes for the pipeline and energy markets. Inhibitors to growth have largely been lifted and alternative energy markets are no longer subsidized. The energy playing field has been leveled, resulting in pipeline work pushing ahead for the first time in four years. Shelved pipeline projects are being reconsidered and even reintroduced, while new opportunities are explored. However, for now, most of the work is primarily to allow delivery of oil and gas wells and reserves that have been pent up since 2021.

Rig manufacturing is approaching full recovery from the market supply upheaval brought on by COVID in 2020. Only minor slowdowns exist and those are rapidly fading away. For the fiber and power markets, with their white-hot project demands, rig and equipment manufacturers now operate with double shifts and some have even added third shifts. Conventional lead times are now in place for the many contractors looking to secure replacement equipment or growing their fleets.

Market growth

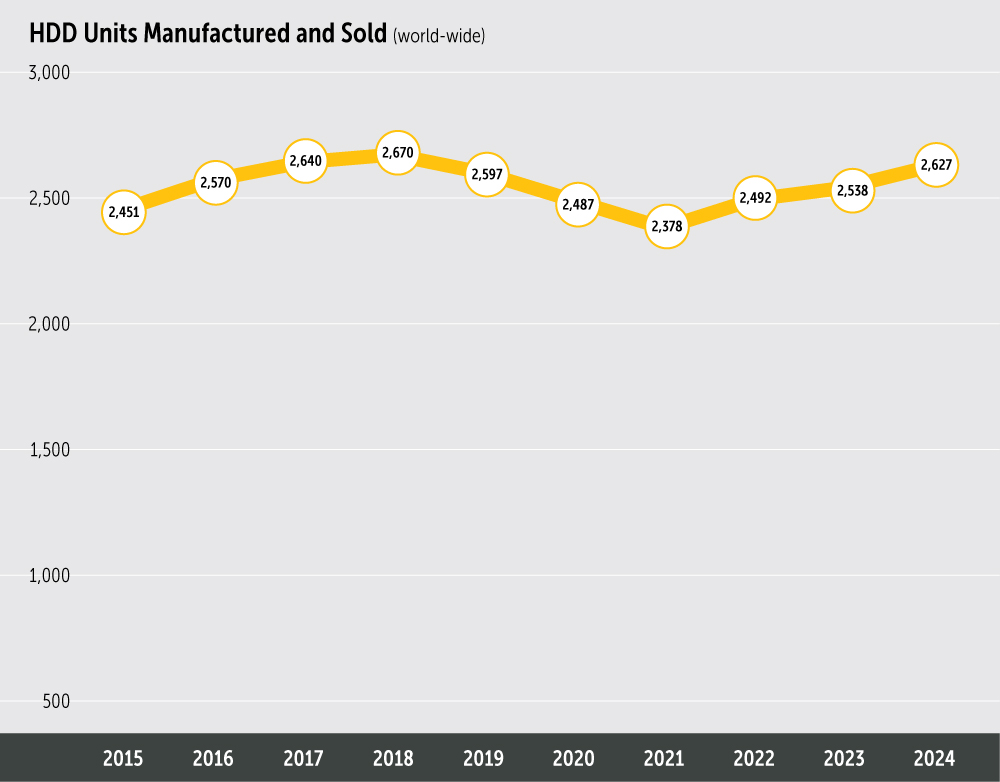

To that end, overall rig sales increased 3.4 percent in 2024, and projections are for sales to climb even further to 3.9 percent in 2025 with a world-wide total of 2,734 rigs expected to reach the market. This will be the most rigs sold, globally, all sizes since the record boom year of 2000.

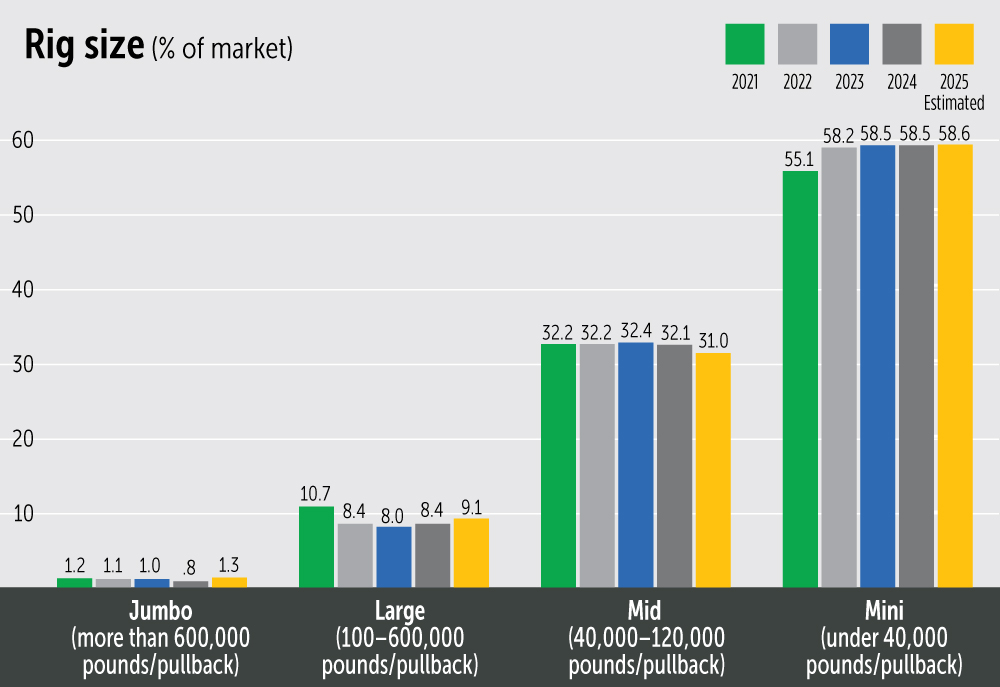

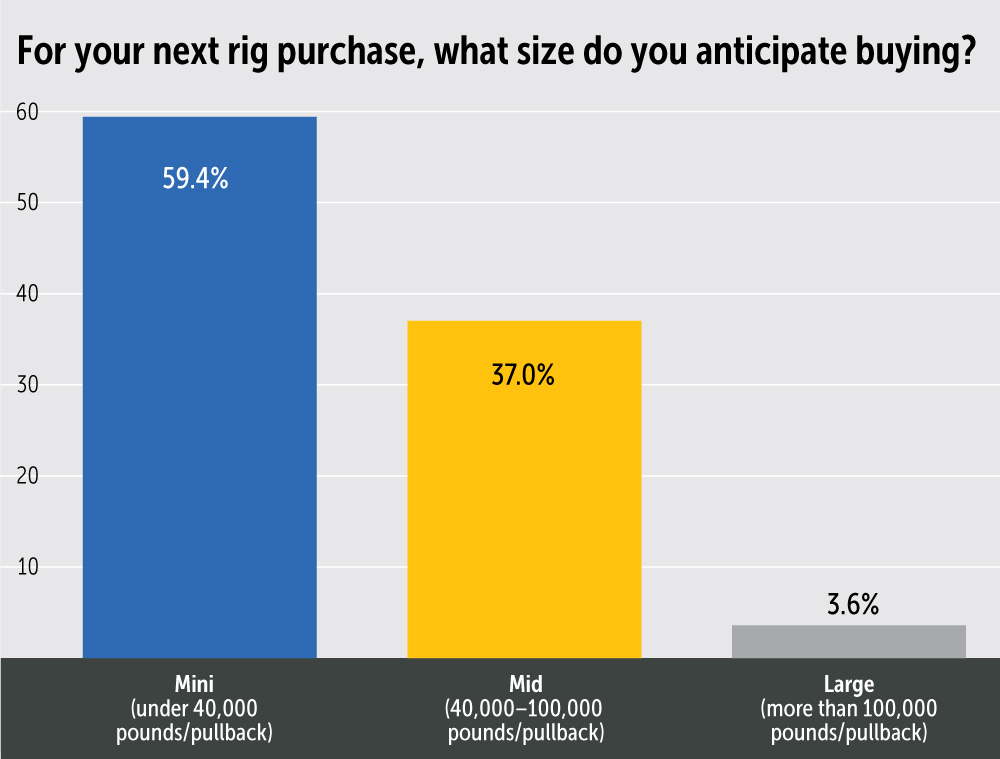

In addition to fiber, other markets are displaying strength, such as electric and gas distribution, water and even sewer applications. These sectors generally utilize smaller rigs (40,000 pounds or less of pullback force) and should continue to account for 59.4 percent of all rig production in 2025. Rig manufacturing in mid-sized units (40,000 to 100,000 pounds of pullback) remains stable at 37.0 percent of the market. Large rig sales (ranging in size from 100,000 pounds to in excess of 1 million pounds of pullback force) are expected to see improved growth of 3.6 percent.

Large rig contractors have proven to be resilient and adaptable. The survey revealed that contractors continue to diversify their work from prototypical oil and gas pipelines to all kinds of utility and even alternative energy projects. Large rigs seem to have found a sweet spot for those willing to stick their toes into the waters of diversification.

It’s not just the rigs themselves that are requiring record levels of work by industry manufacturers. Various accessories, such as mud systems, downhole tools, drill pipe, trackers, etc., have all combined with rig demand to force many manufacturers/suppliers to add workforce, operating plants around the clock to ensure steady delivery as they struggle to meet demand.

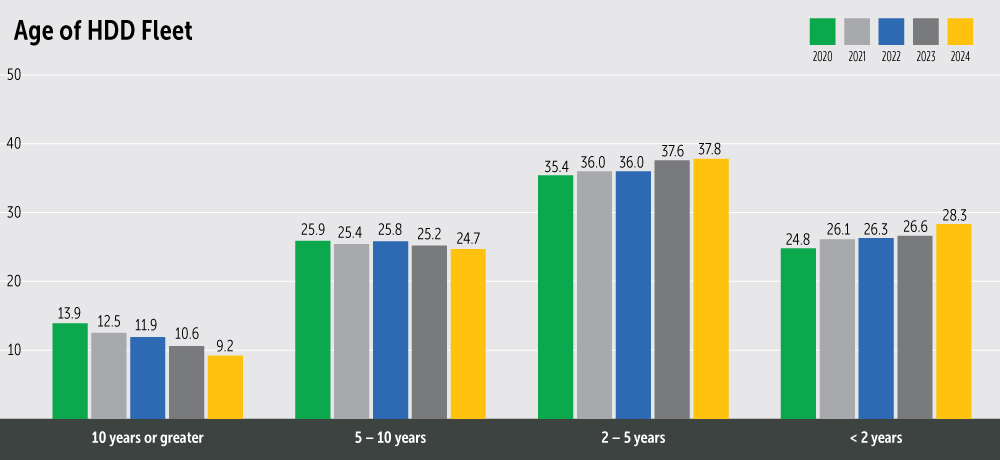

The overall rig fleet continues to get younger. Rigs more than 10 years old comprise 9.2 percent of the market; 24.7 percent are five to 10 years of age; 37.8 percent are two to 5 years old; and 28.3 percent of active rigs are less than two years old.

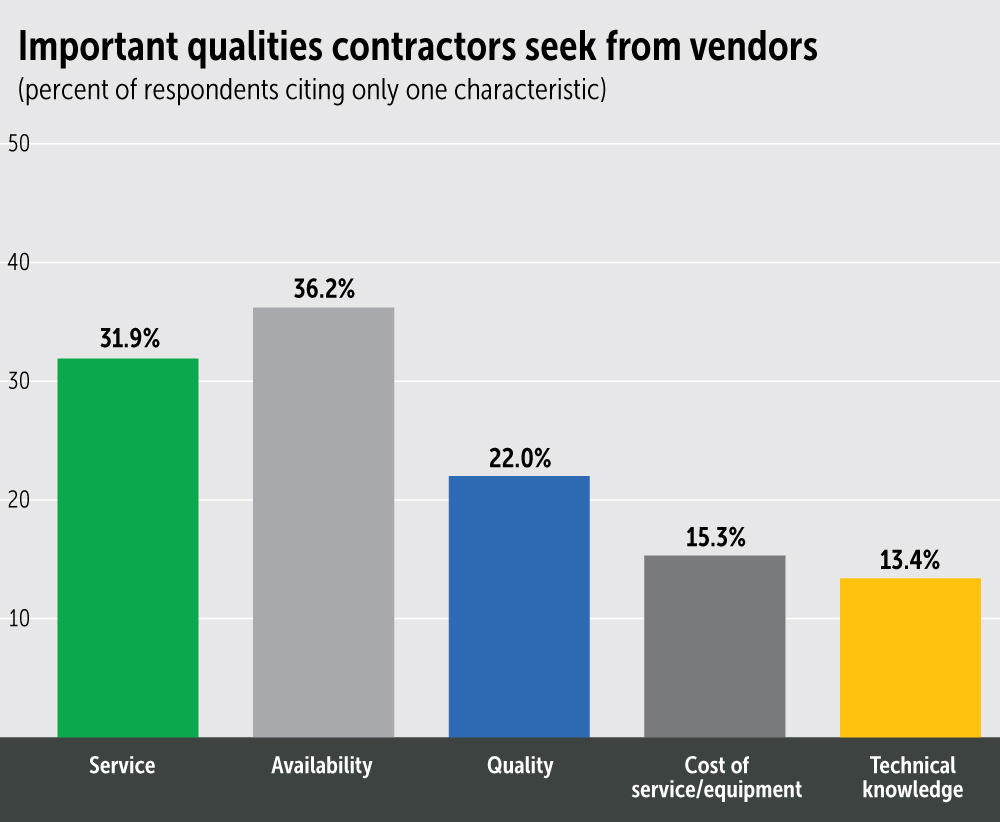

The survey historically asks contractors about the most important characteristics and needs they seek from their manufacturer and supplier partners. Predictably, in 2024, availability/field support of equipment was at the top of the list, as noted by 36.2 percent of the survey respondents. Service remained a strong desirable characteristic of vendors at 31.9 percent. Quality was third place at 22.0 percent, followed by cost of service/equipment at 15.3 percent and technical knowledge at 13.4 percent.

The good news is that manufacturing recovery seems virtually complete from the horrific distribution and parts inaccessibility in the post-COVID years. Manufacturers and distributors report relatively normal or rapidly returning to normal parts accessibility in reasonable timelines. Good news, indeed, for contractors with pressing projects as fiber and power owners continue to pursue active projects.

HDD growth curve, long-term outlook

In essence, the HDD market is:

- Booming for fiber

- Strong and growing for:

- Power (both distribution and transmission)

- Water

- Strengthening with opportunities emerging for energy pipelines

- Experimenting for all kinds of uses continues at a high rate

How long will the overall strong HDD market last? Short answer is indefinitely. HDD is a technology that continues to evolve. There now is rarely any kind of soil or rock that can’t be effectively and successfully drilled while accuracy increases regularly, efficiency steadily improves and cost effectiveness, along with practicality, drive the use of HDD in every corner of utility infrastructure work.

And in 2025, as it has been for the past few years, fiber continues to power the HDD market forward. While private investment has led the fiber wave for years – and still does – now federal Broadband Equity, Access, and Deployment (BEAD) Program money (a byproduct of the Infrastructure Investment bill) is pumping more funding into the pot – $42.5 billion.

While some of that money can now be spent on satellite infrastructure, the majority is still being plowed into the more reliable and faster land systems. States and localities are desperate to build and enhance their fiber engines for economic development. Subsequently, local funding and supporting steps from states are accelerating in order to embrace and deliver fiber networks. All this as fiber systems technology continues to evolve, advance, achieves diversity and becomes more of a fit – an affordable fit – for smaller markets.

Powering up

The electric power market is just getting started. The Infrastructure Bill provided billions for utilities to “harden,” or strengthen, their lines and weatherproof against extreme weather. Research has shown that the best way to harden utilities is to take them underground. While not a foolproof solution, it is imminently better than overhead lines that take the full brunt of a weather event, be it a tornado, hurricane or ice storm.

Still, far too many utilities are going the cheaper route of hardening overhead lines in lieu of moving those lines underground. But with each passing year and every disaster that befalls the nation, the absolute need to take power cable out of harm’s way grows and gains momentum. At some point, all power utilities will be facing a determined and angry set of city and state governments for not having moved utilities underground – no matter the cost (real or perceived).

While President Trump has been a huge supporter of conventional energy drilling for oil and gas, his push to “Drill Baby, Drill” may be slow to materialize. Oil companies like to raise the bar on what they need to make a reasonable profit. Lower prices based upon the West Texas Crude benchmark typically deter additional drilling. Of course, extraction technology keeps getting better and locating high-yield oil and gas sources keeps reducing drilling risks which, in theory, allows higher profits at lower overall prices.

However, Saudi Arabia and OPEC are an example of different benchmarks. They are maintaining higher production rates in an effort to gain market share. Regardless, oil and gas work is strengthening in the U.S. for probably up to four years, if only to accommodate pent-up demand held in check by onerous Biden era rules and regulations. In 2028, a new administration will play a key role on whether or not that will continue.

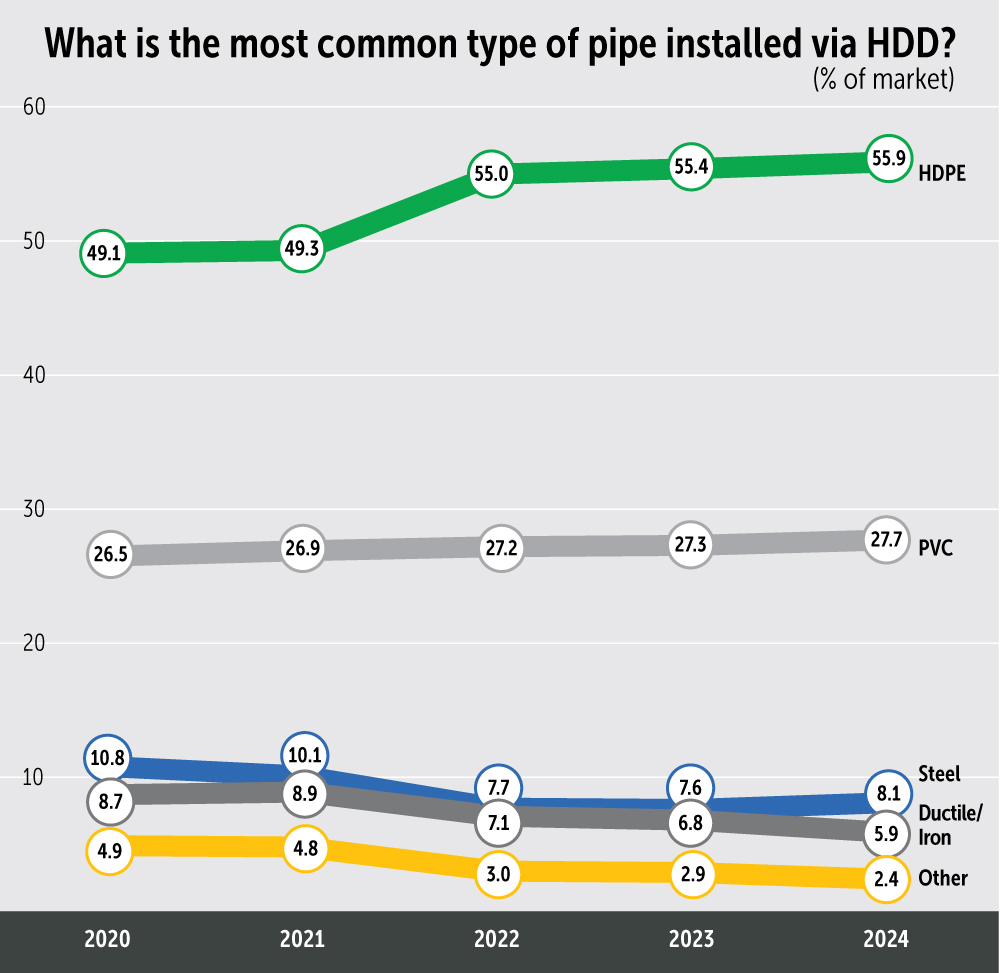

The potable water market for HDD has taken on a life of its own. Pressurized mains have been converted to PVC or HDPE pipe for decades now and HDD has proven to be an effective technology fit to accomplish that transformation and growth. Plus, HDD is more environmentally favorable. Survey figures indicate that industry expects the HDD water market to expand, yet again, in 2025.

The sewer market is still hit and miss. Force mains remain a viable option for specific HDD opportunities, but gravity sewers typically demand tight installation tolerances. While those kinds of tolerances can sometimes be obtained through HDD, it requires more time and effort and are rarely profitable ventures. When the technology of HDD to achieve those very tight line and grade tolerances is discovered – profitably – another market to rival water will explode.

Comments